U.S. Streaming: Which new Netflix films and series from 2024 are (likely) eligible for the Streaming Bonus obtained during the 2023 strikes?

2024 was the first year of their implementation. Let's take a look at how it plays out on Netflix.

📈 Methodology used in this analysis.

Please read this carefully before looking at the charts, as there are many moving parts here, and all the figures should be taken with caution.

What is the viewership threshold required to qualify for the Streaming Bonus?

It’s (relatively) simple: a title must accumulate as many or more Complete Viewing Equivalents (CVEs) (or views) as 20% of the U.S. subscriber base of the streaming service as of July 1 of the given year, within 90 days of availability.

How many subscribers does Netflix have in the U.S.?

This is where things start to get uncertain. In July 2024, Netflix had 84 million paying subscribers in the U.S. and Canada (the UCAN region). To estimate the number of U.S. subscribers, a common approach is to subtract 10%, giving an approximate total of 76 million Netflix subscribers in the U.S.

What is the viewership threshold?

20% of 76 million subscribers results in a threshold of 15.2 million CVEss within 90 days for Netflix titles. However, if the actual U.S. subscriber count is higher, the threshold increases accordingly. If it’s lower, the threshold decreases. Each streaming service has different thresholds based on their U.S. subscriber numbers.

What data will we be using to determine if a title has surpassed this threshold?

Here’s where additional uncertainties come into play:

Nielsen’s methodology – Nielsen only tracks viewership on TVs, omitting views from smartphones, PCs, etc. This means a significant portion of viewership is not accounted for in their data.

Lack of data beyond the first few weeks – Most titles drop out of Nielsen’s Top 10 after a few weeks, making it difficult to assess their 90-day performance. Fortunately, I have some comparison models that estimate viewership trends between Day 14/28 and Day 90, allowing me to outline a potential viewership range at 90 days. However, each title behaves differently, so actual numbers could fall outside this estimated range.

Now that the necessary precautions have been outlined, let's move on to the results—starting with the films!

🎥 Films.

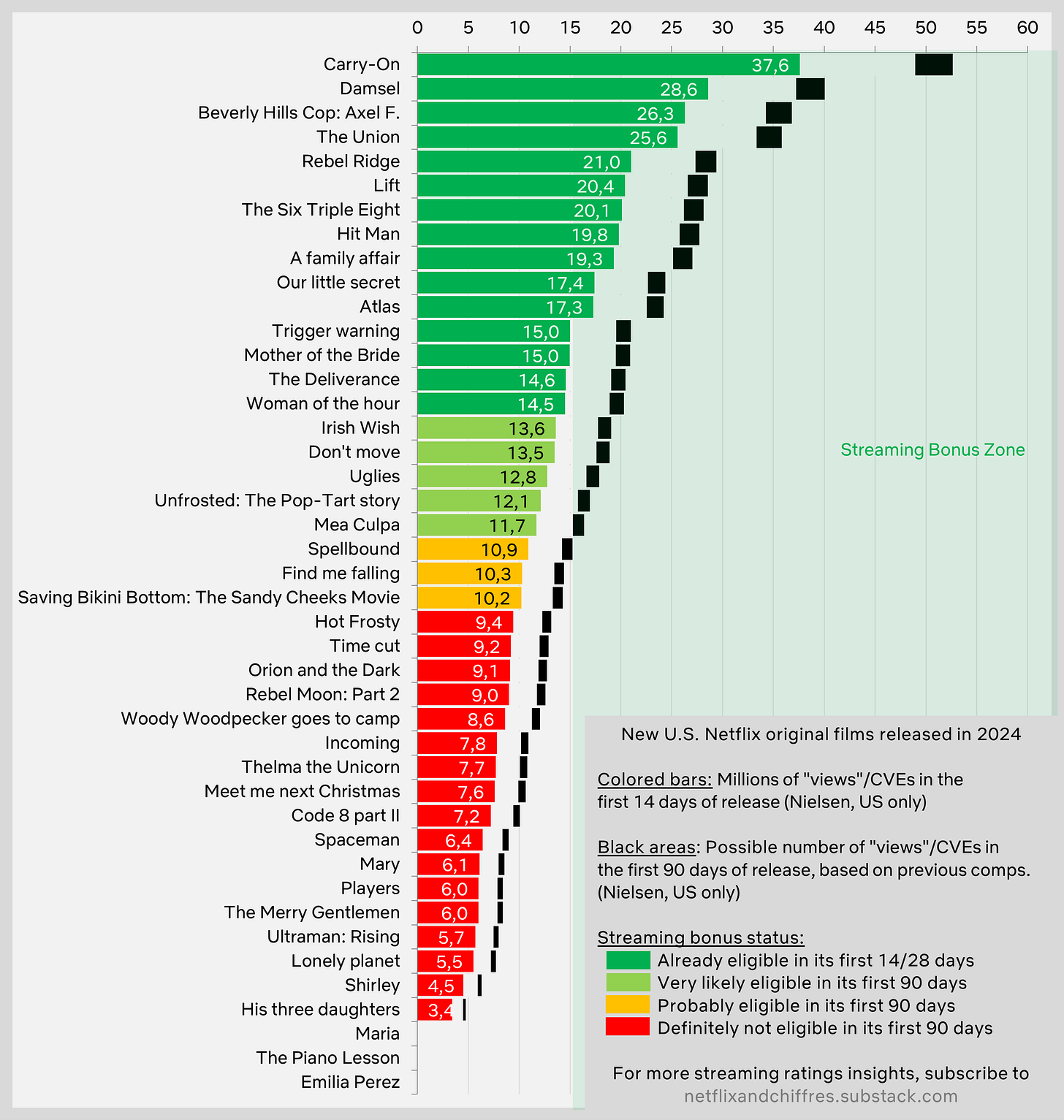

Among Netflix's 2024 films, 15 titles reached the threshold within the first 14 to 21 days of release. Additionally, I estimate that five more likely crossed the threshold by the 90-day mark. This means that just under half of Netflix's films in 2024 successfully qualified for the Streaming Bonus.

For the others, it’s more complicated, if not nearly impossible to get the Bonus. Among the likely "losers," notable examples include Rebel Moon: Part 2 by Zack Snyder and Spaceman starring Adam Sandler. Prestige films also struggled to stand out, such as Shirley, His Three Daughters, and even The Piano Lesson, Maria and Emilia Perez.

📺 Series.

For series, it's important to remember that Nielsen’s methodology combines viewership from all seasons of a show, while the Streaming Bonus applies only to specific seasons. This means that Nielsen's numbers are unusable as-is for series that returned in 2024 with a new season.

When focusing on new U.S. series from 2024, the picture is less favorable than for films, with only 37% of them reaching the required viewership for the Streaming Bonus. None of these series managed to cross the threshold within their visible run in Nielsen’s Top 10, although The Perfect Couple came close.

(Fool Me Once is not included in this chart because it's a British series and therefore not eligible for the Streaming Bonus.)

At the bottom of the ranking, 3 Body Problem and The Madness are unlikely to qualify for the Streaming Bonus. Once again, the reasons behind the cancellation of The Brothers Sun and Dead Boy Detectives are quite telling on the chart.

And what about the other streamers?

Netflix is the easiest streamer to analyze because, for example, it releases its series in a binge format, and each series tends to make it into Nielsen's Top 10, allowing for articles like this one.

Another challenge is that for streamers like Paramount+, Apple TV+, or Prime Video, we don’t even know the number of subscribers in the U.S. or the UCAN region, making it impossible to establish a viewership threshold.

We are therefore left with the films and series released in binge format on the three other services for which we can determine a threshold, namely Hulu, Disney+, and Peacock. We can also conclude that those that failed to make it into the Top 10 did not receive the bonus.

Disney+ (threshold of 10M CVEs for 50M U.S. subscribers)

✅ Descendants: Rise of Red (Film)

Hulu (threshold of 10.4M CVEs for 52M U.S. subscribers)

❌ Suncoast (Film)

❌ Reliance (Film)

❌ Echo (Series)

Peacock (threshold of 6.6M EVCs for 33M U.S. subscribers)

🤷 Ted (Series)

❌ Apples never fall (Series)

❌ Those about to die (Series)

New Weekly Series

For weekly series, Nielsen’s limitations are even more pronounced. Multi-season series are excluded, as well as those that never made it into Nielsen’s Top 10 throughout their entire run, and those on services where we don't have a clear threshold.

The agreement between studios and the Guilds mentions the first 90 days after release, but how does this apply to a weekly release schedule? Does it mean 90 days for each episode, as Netflix does? Probably, but it’s quite difficult to estimate using Nielsen's data.

Once all these limitations are accounted for, there isn’t much left to analyze. I’d like to once again thank the Twitter account TVGrimReaper for consistently leaking Nielsen’s Top 10 rankings for each service during a few months until mid-2024, allowing us to gather at least some fragmented insights on certain series.

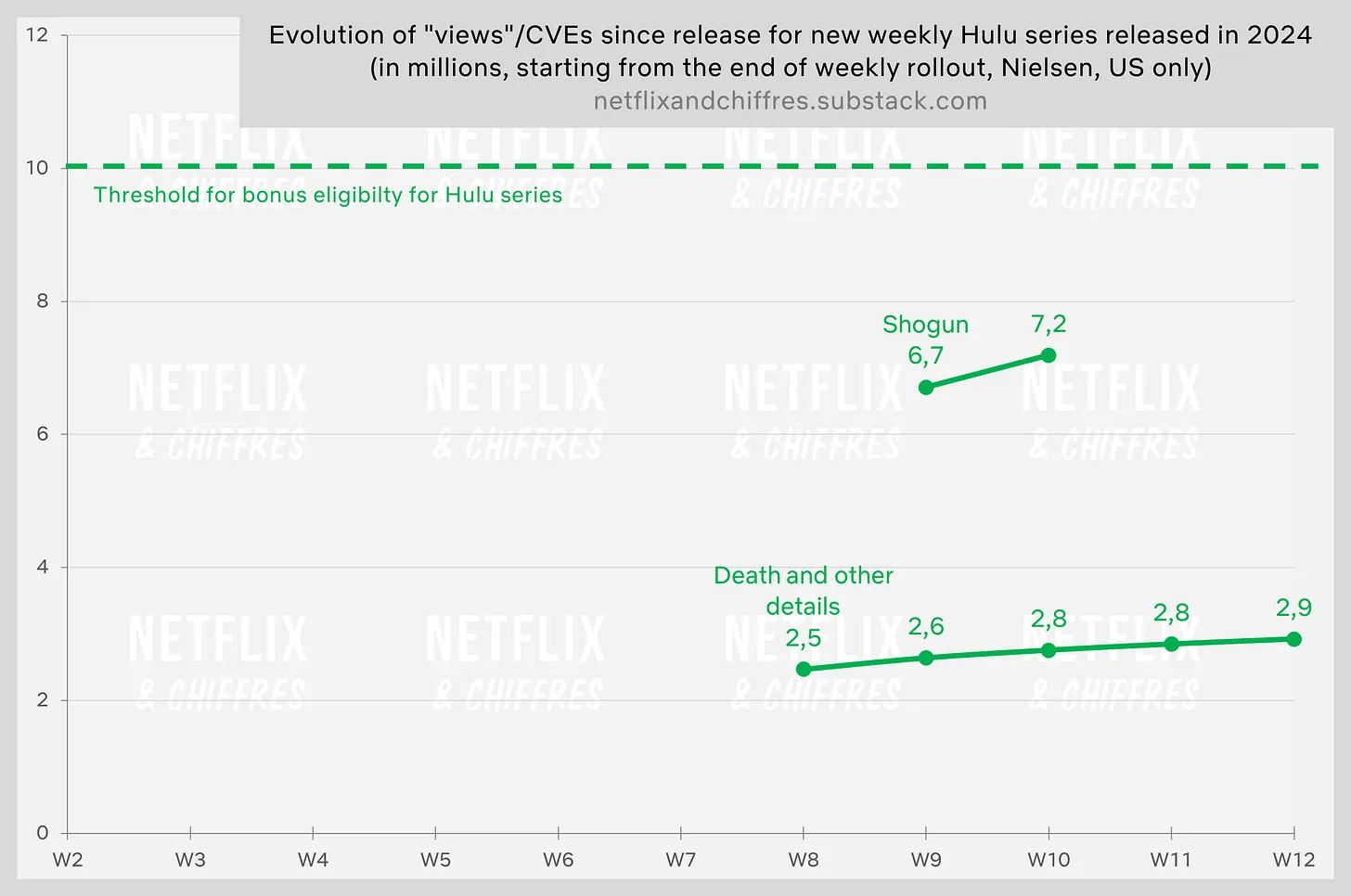

Let’s start with Hulu series, as I have at least two that can be analyzed. Death and Other Details (canceled after one season) clearly didn’t generate enough viewership to reach the bonus threshold for Hulu—hence its cancellation.

The case of Shōgun is a bit harder to determine. The series had accumulated 7.2 million CVEs one week after its finale, so it’s reasonable to assume it eventually surpassed the 10.4M CVE threshold. However, did it achieve this within the first 13 weeks for each episode? That’s impossible to say with the data I have.

Here are some other weekly series from different streamers and my hypothesis on their Streaming Bonus status:

✅ Landman (Paramount+) – Approximately 17.5M CVEs by the end of its run, that’s way enough to get the Streaming Bonus.

🤷 Masters of the Air (Apple TV+) – 4.2M CVEs four weeks after its finale. If Apple TV+ has around 20M U.S. subscribers, this might be enough.

🤷 The Acolyte / Agatha All Along (Disney+) – Both series intermittently appeared in the Top 10, but I can’t fully fill in the gaps. Their weekly CVE average is around 7–8M, so they may have passed Disney+’s 10M CVE threshold within three months. However, The Acolyte was canceled, indicating that even Disney didn’t see it as a success.

❌ Constellation (Apple TV+) – 1.3M CVEs two weeks after its finale and already canceled, so the full picture is clear.

❌ Expats (Prime Video) – 1.7M CVEs two weeks after its finale, and considering Amazon Prime has over 40–50M U.S. subscribers/users, this likely wasn’t enough.

❌ Skeleton Crew (Disney+) – Hard to see it surpassing the threshold when it never made it into Nielsen’s Top 10.

That concludes this overview of the first year of the Streaming Bonus! We'll catch up in a few days to discuss Netflix's numbers from the past week.