A look at the Q3 2024 financial results of the main streaming services.

Netflix, Max, Disney, Peacock, Paramount+, and Hulu have released their financial results for Q3 2024, and we’re going to break it all down with charts.

Foreword

A few things should be kept in mind when looking at the following charts, with the most important being that the various services do not operate in the same geographical areas. Therefore, these comparisons are not perfect, even though some metrics, such as average revenue per subscription and others, can be compared.

If you enjoy what you’re reading, subscribe or share!

Global streaming services

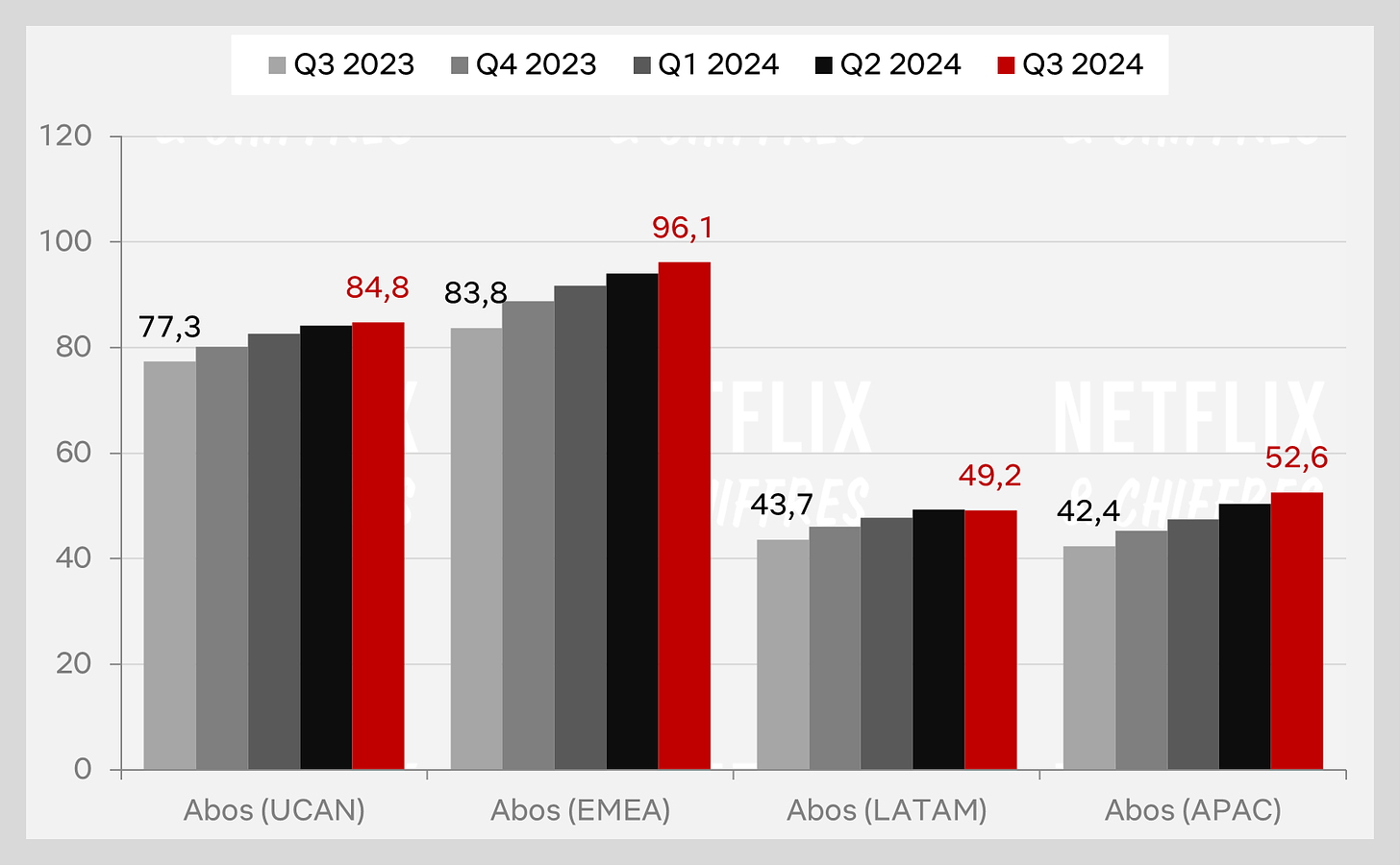

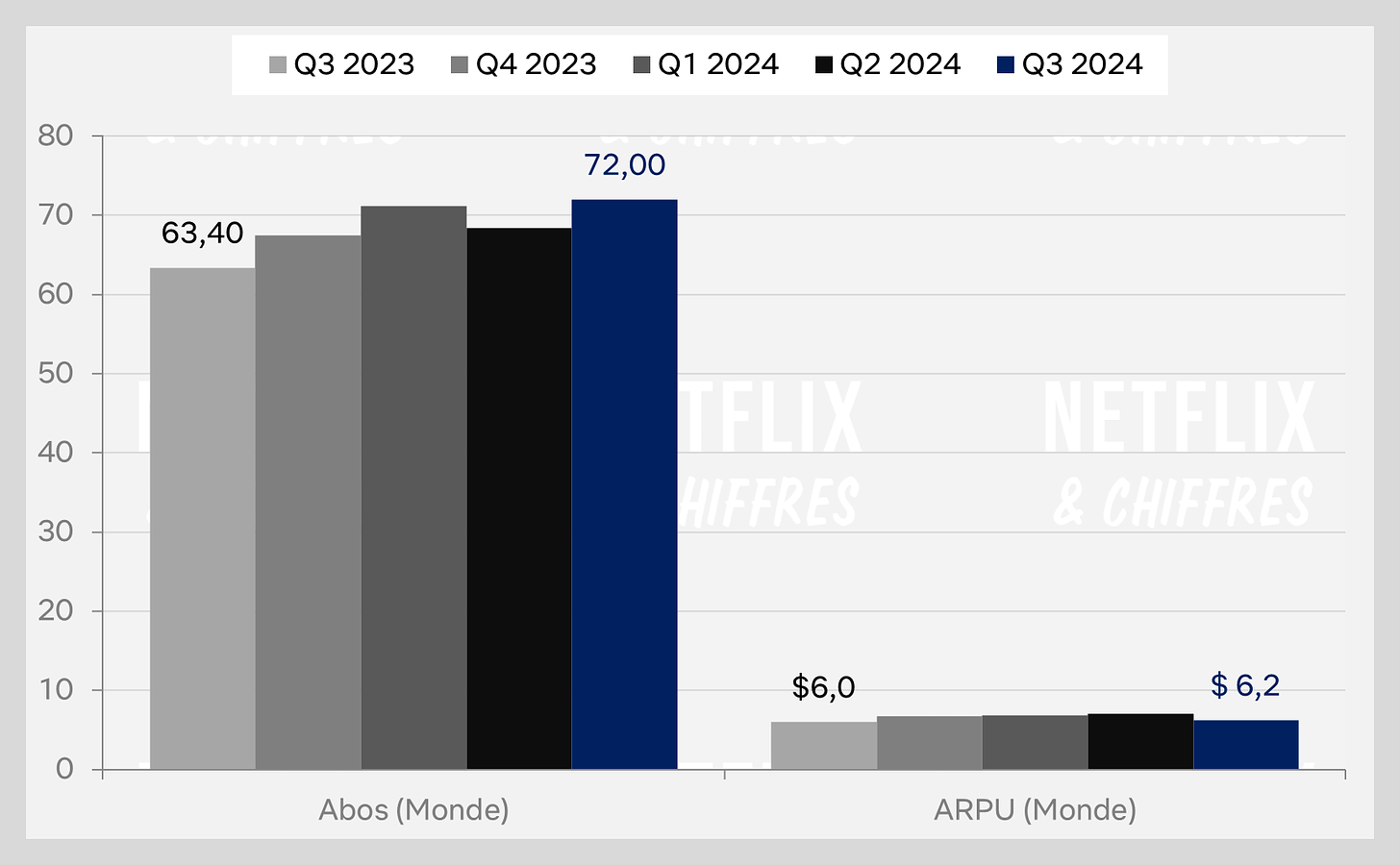

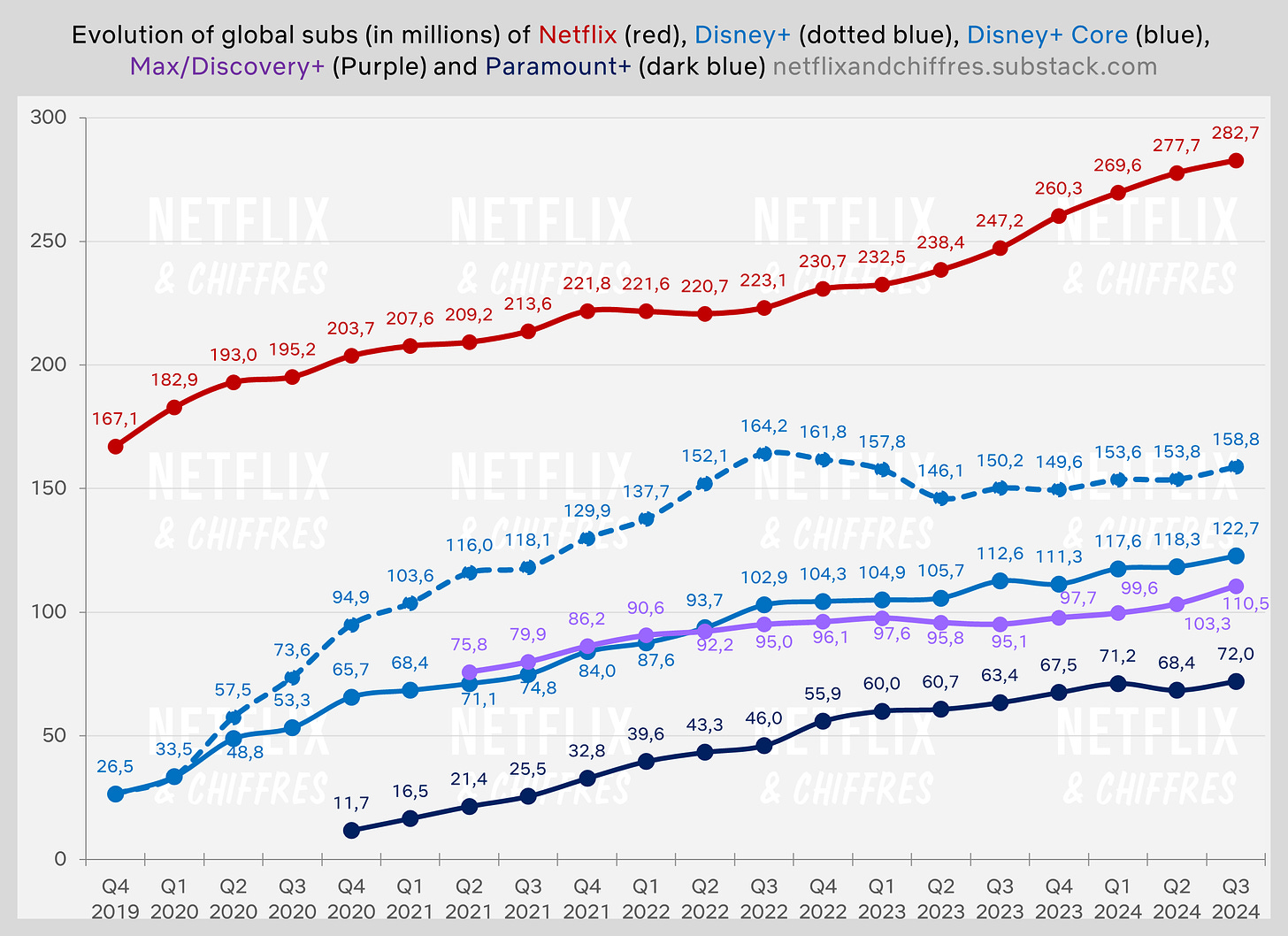

It’s another relatively good quarter for Netflix, which has reached 282 million subscribers, gaining in nearly every region except Latin America, where there was a slight decline.

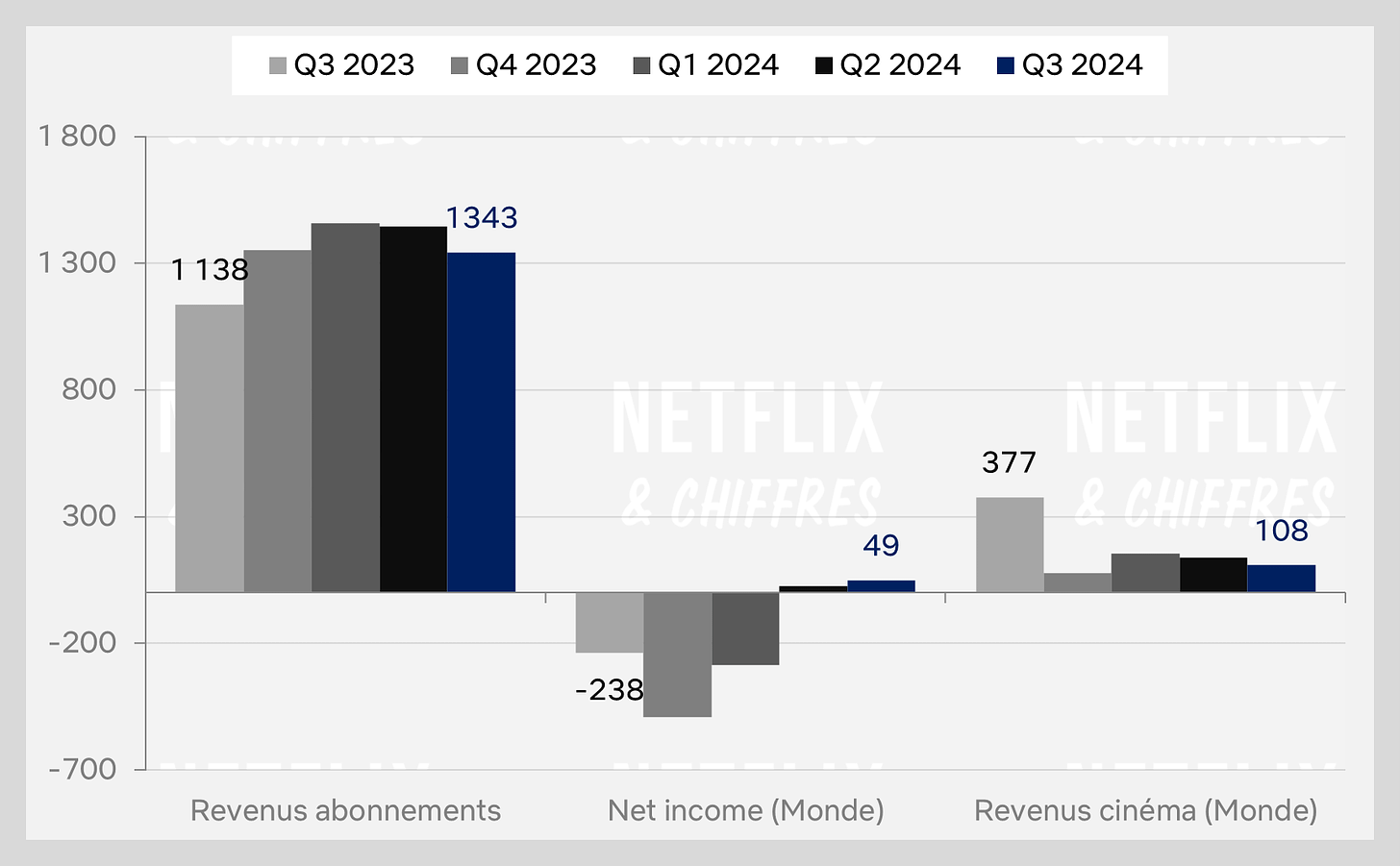

Revenues have also increased, even in Latin America, despite the drop in subscribers.

Overall, revenue reached $9.8 billion in the third quarter, with $2.3 billion in profit. For the first nine months of the year, Netflix generated $28.7 billion in revenue and $6.8 billion in profit.

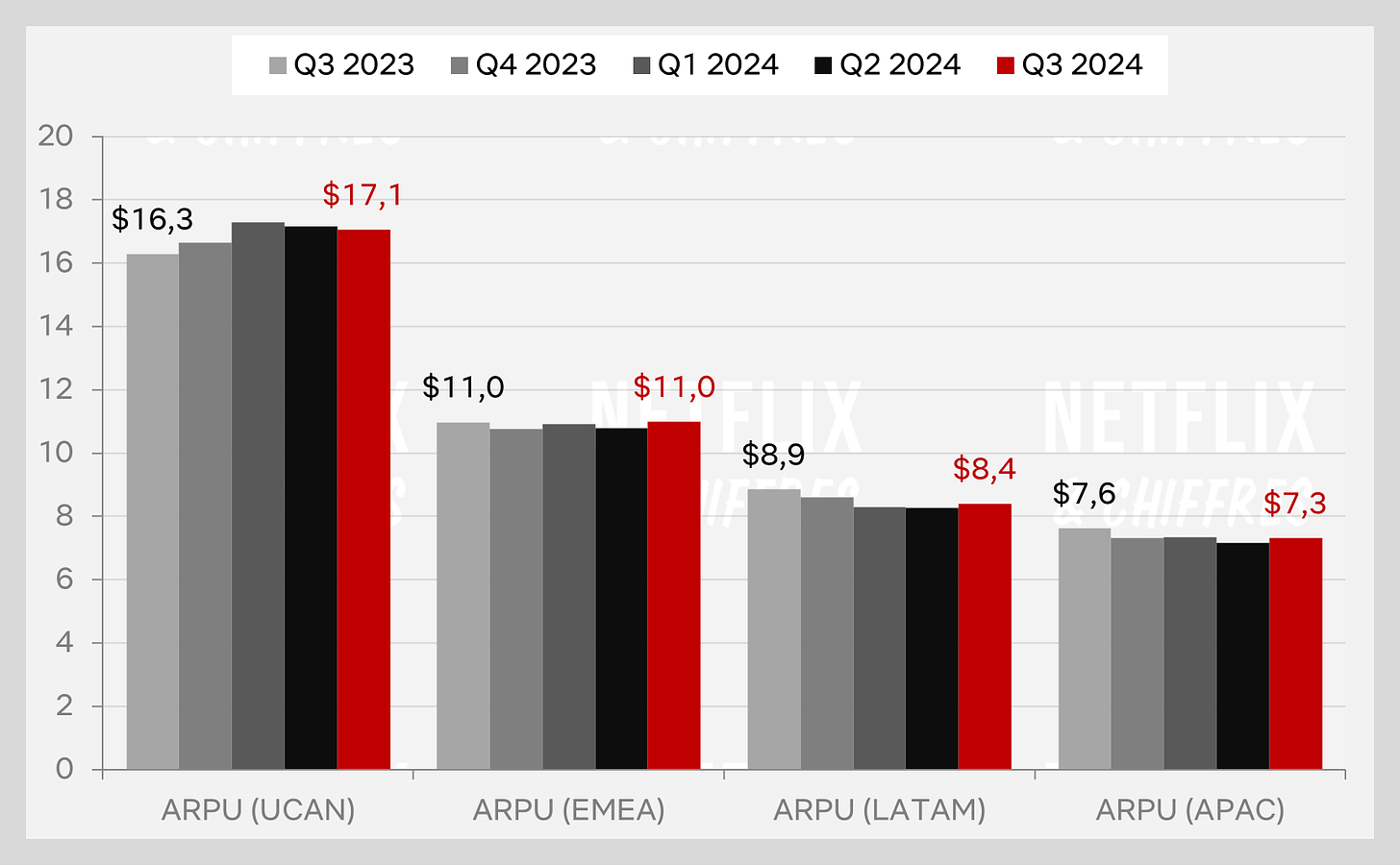

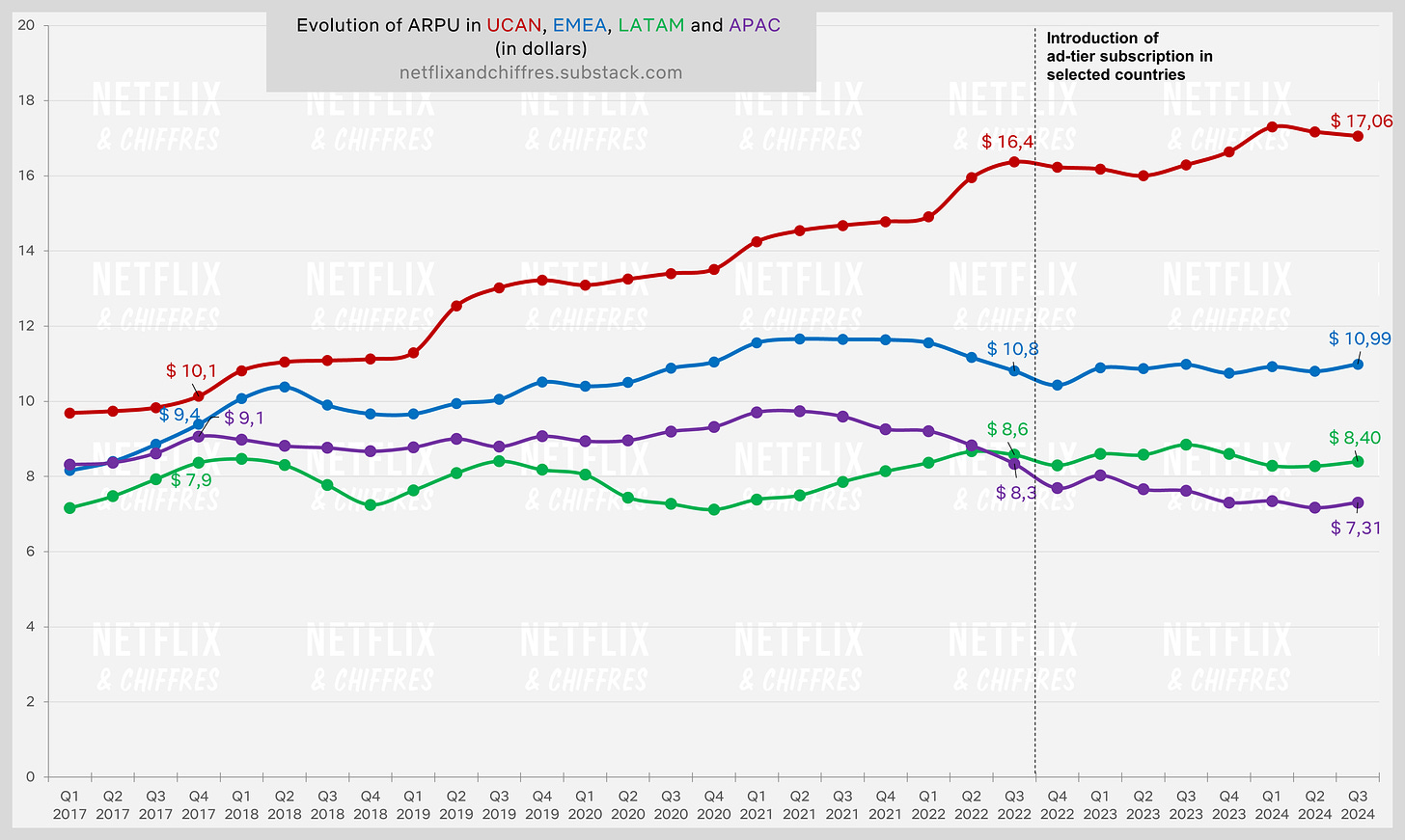

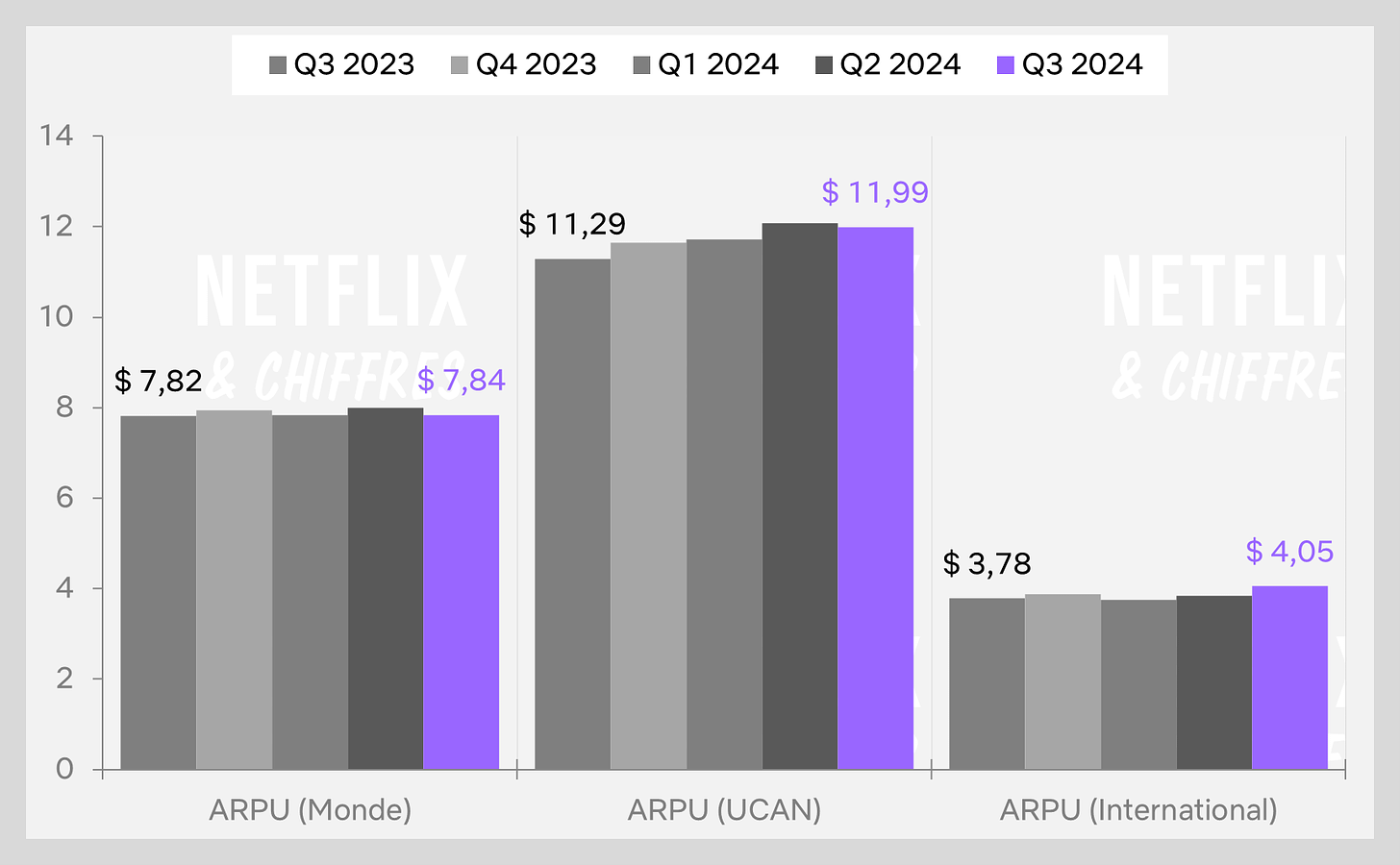

Now, let’s take a look at the evolution of the average revenue per subscriber, as it varies significantly by region. Over the past year, it has increased in the US and Canada, remained stable in Europe, Africa, and the Middle East, and decreased in Latin America and Asia.

Zooming out to 2017, we can see that the average revenue per subscriber in the Asia-Pacific region has decreased from $9.1 to $7.3, while during the same period, it has increased from $10.1 to $17 in the US and Canada.

The ad-supported subscription plan now has 70 million users worldwide, up from 40 million in May.

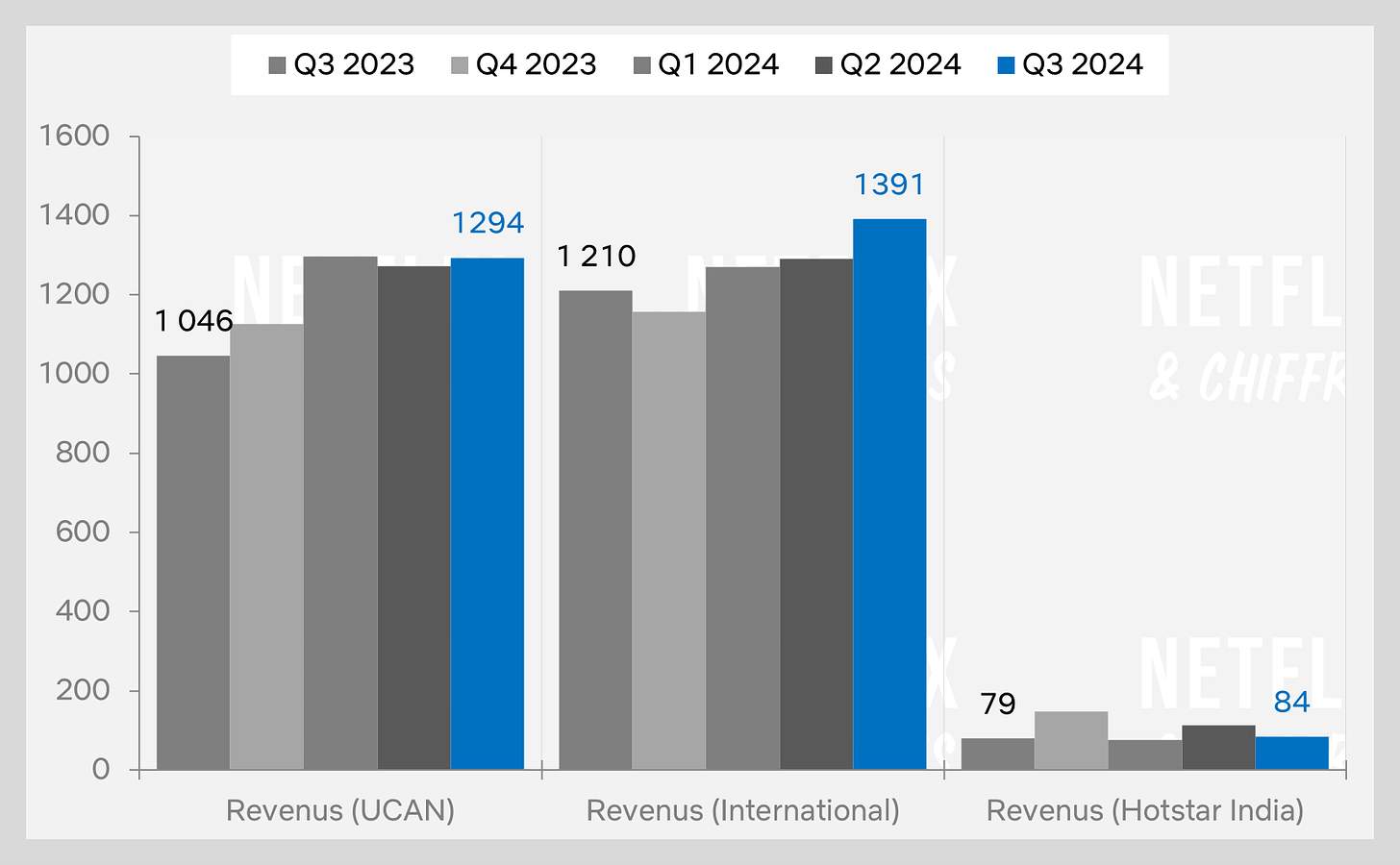

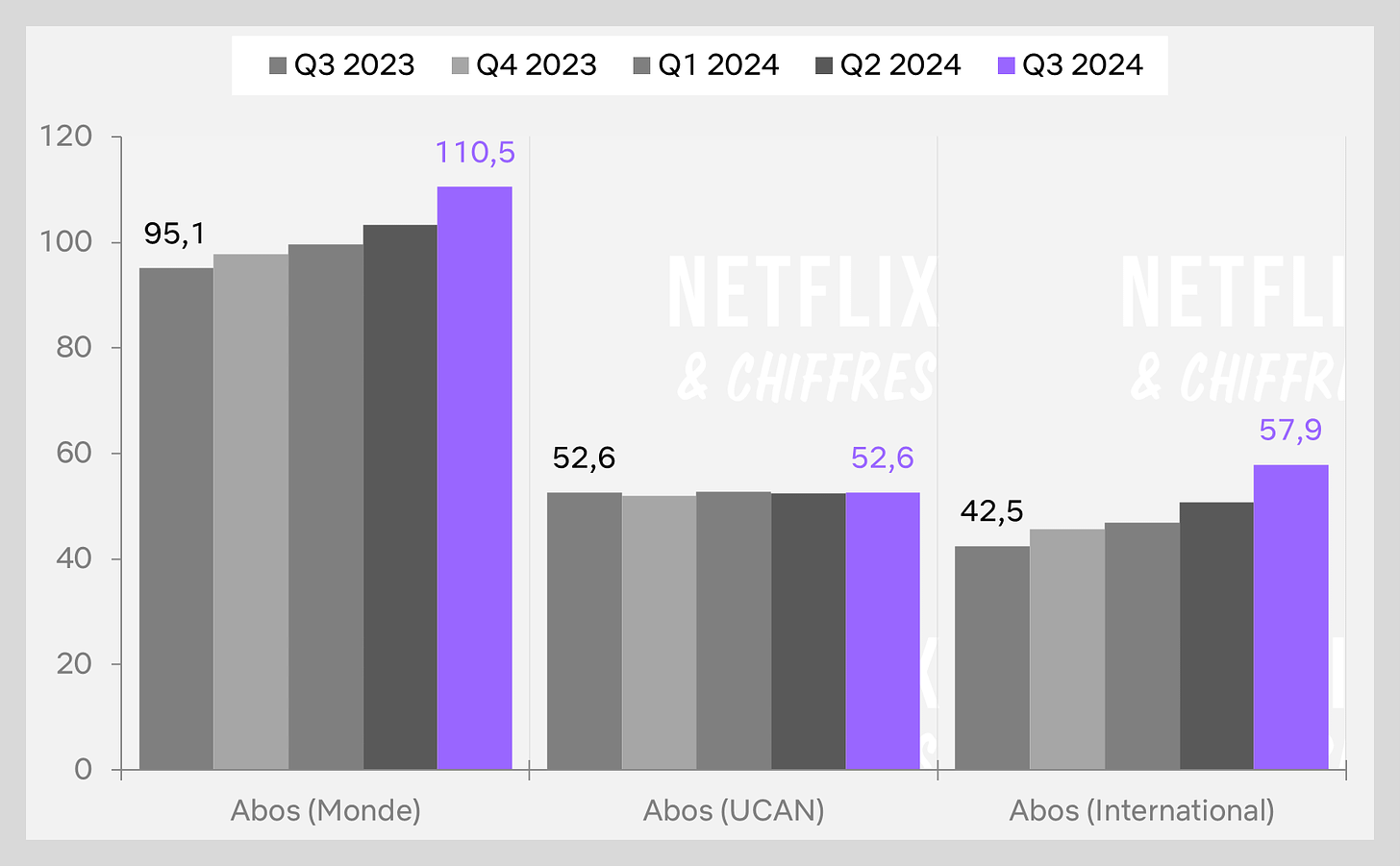

For Disney+, it’s also been a strong quarter, with subscriber growth in all geographical regions. Notably, international markets outside the US and India saw a rebound even without the service launching in new territories. In the US, the launch of the bundle with Max in July 2024 may have contributed to the increase in subscribers.

Revenues have also surged, particularly internationally, following price increases.

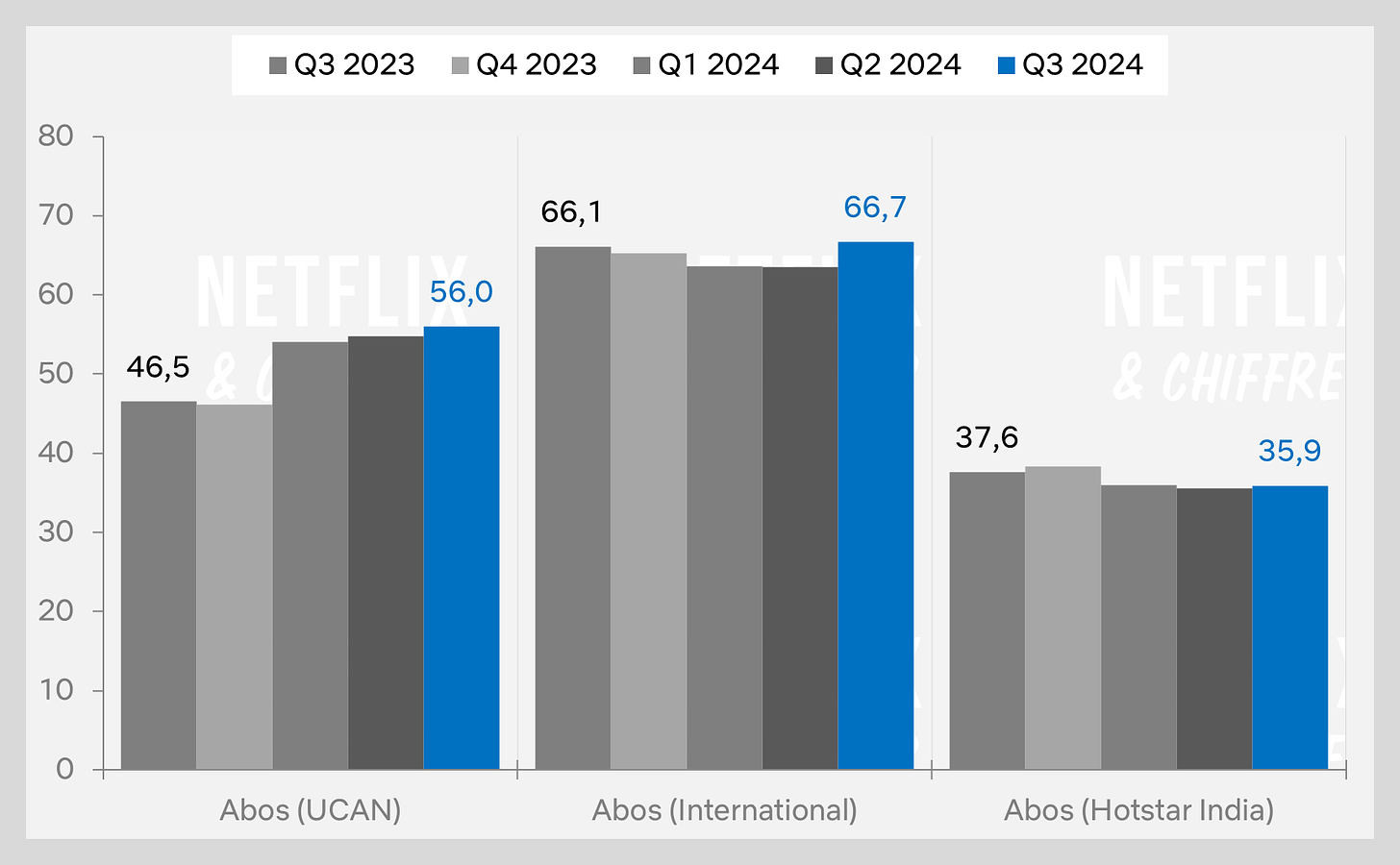

The question of ARPU (Average Revenue Per User) is interesting, as it has been declining for four consecutive quarters in the UCAN region, while it’s increasing internationally. In India, I’m not sure how this ARPU can fluctuate so drastically, but that’s the trend.

This end of fiscal year 2024 for Disney was also an opportunity to revisit the goals set during the Chapek era, which were as follows: a service that generates profits and a service with between 230 and 260 million subscribers (revised to 215-245 million in August 2022, still for 2024), within a total of 300-350 million subscribers across Disney+, Hulu and ESPN+.

Well, as for profits, that’s covered since Disney's streaming division is profitable. But when it comes to subscribers… they’re far off the target. One could attribute this to the major Netflix correction in the financial markets in Q1 2022, but the latest goals were set after this correction (though before Iger returned to replace Bob Chapek). Disney+ currently has 158.8M/122.7M subscribers worldwide, depending on whether you count Indian subscribers, which is 65 million below the revised lower forecast. If we consider all subscribers to Disney+, Hulu, and ESPN+ (counting India and not excluding the US Disney Bundle duplicates), the total reaches 236.4 million subscribers, the highest since late 2019, but nearly the same level as Q3 2022.

As you can see, 236.4 million subscribers is not quite within the 300-350 million range estimated at the end of 2020. And this range is likely unattainable if we exclude the 35.9 million Disney+ subscribers in India, as will probably be the case officially in a few months. Forecasts really only hold weight for those who believe in them.

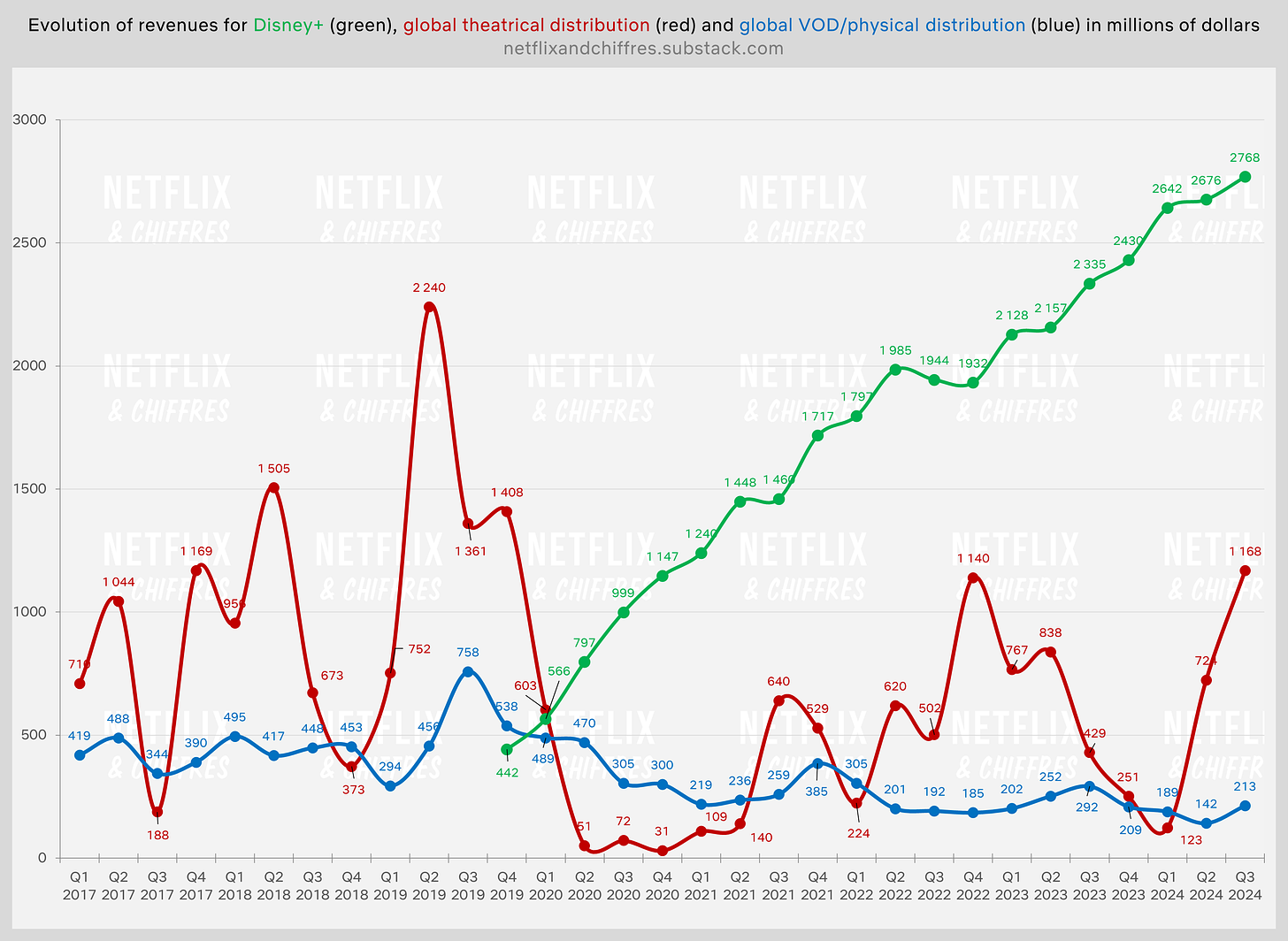

Now, let’s move on to other “related” streaming revenues, such as cinema and physical/VOD sales. This quarter saw the box office successes of Deadpool vs Wolverine and Inside Out 2. The red line continues to rise but is still at roughly the same level as the quarter of Avatar 2’s release.

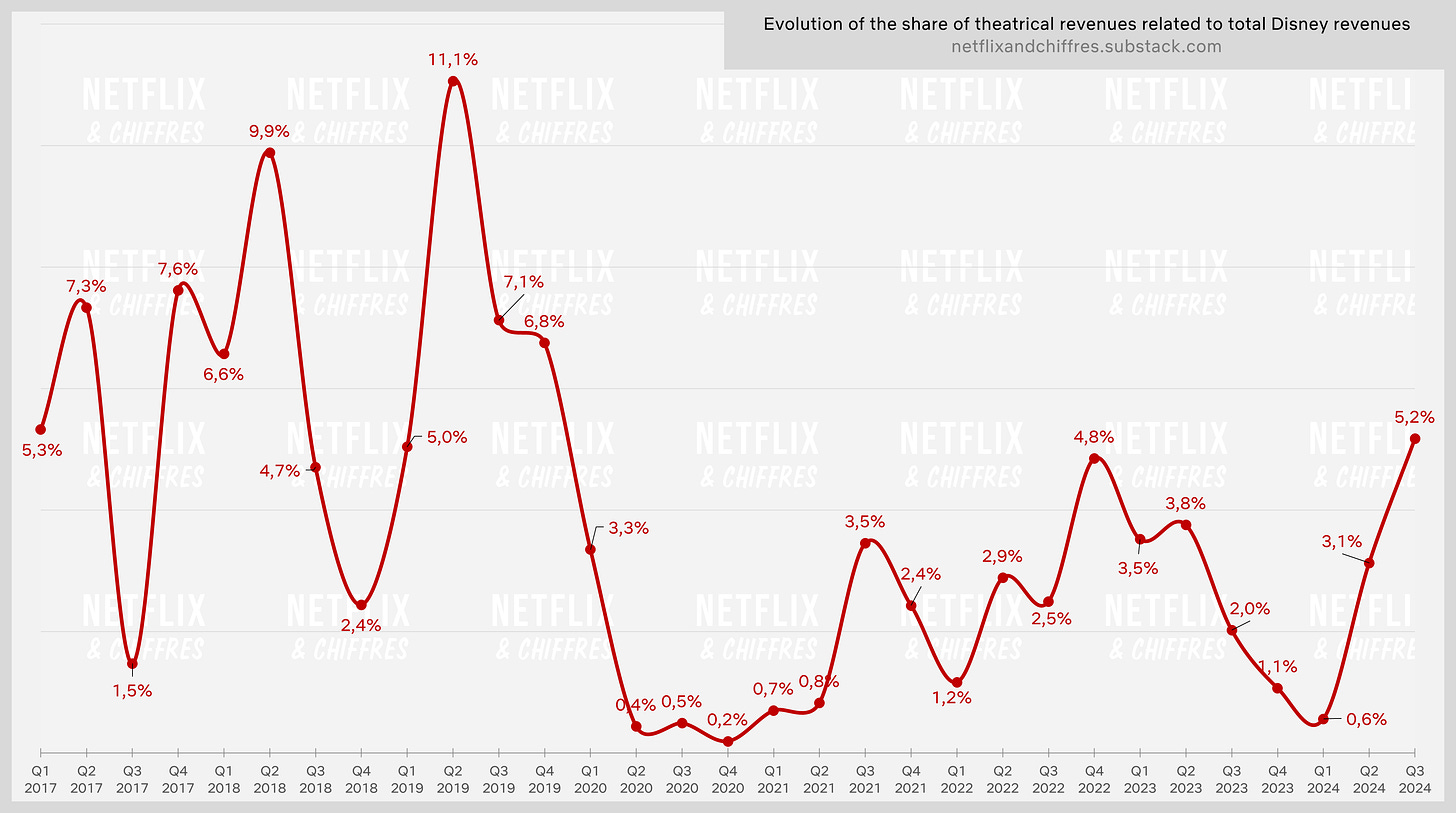

Interestingly, the share of cinema revenues within Disney’s total revenues has surpassed 5% for the first time since Q4 2019, which was both the quarter of Disney+’s launch and the last pre-pandemic quarter.

So, there are some interesting developments at Disney, with a return to the pre-pandemic world, but now with streaming revenues added. In the US, ESPN+ will soon have its own tile on Disney+, alongside Hulu, marking a new step toward the convergence (at least technically) of the Disney Bundle.

Warner Bros. Discovery's streaming services, including Max, have seen a surge in subscribers this quarter, thanks to the launch of Max in numerous countries and possibly also the Olympics being broadcast on the service, particularly in Europe. They have reached 110 million subscribers worldwide, but the growth is entirely driven by international markets, as the US remains flat year-over-year.

The average revenue per subscriber is down, except internationally, where it surpasses $4.

Finally, Warner Bros. Discovery announces that its streaming services are profitable, but it’s the same story, quarter after quarter: the figures include linear revenue from HBO in the US, which helps significantly, while deliberately muddying the waters.

How do you estimate the number of new Paramount+ subscribers brought by the inclusion of the service in Canal+ France’s subscription plans in August? Take this number and compare it to the 3 million new subscriptions reported by Paramount for its service globally in Q3 2024.

The ARPU is down (which happens when a service is included in a bundle), and the total global subscription revenues have also decreased significantly. However, the service was still in the green, with a $49M profit.

Overview of the global services at the end of Q3 2024.

The numbers are quite stable this quarter, with all services adding between 3 and 7 million subscribers globally.

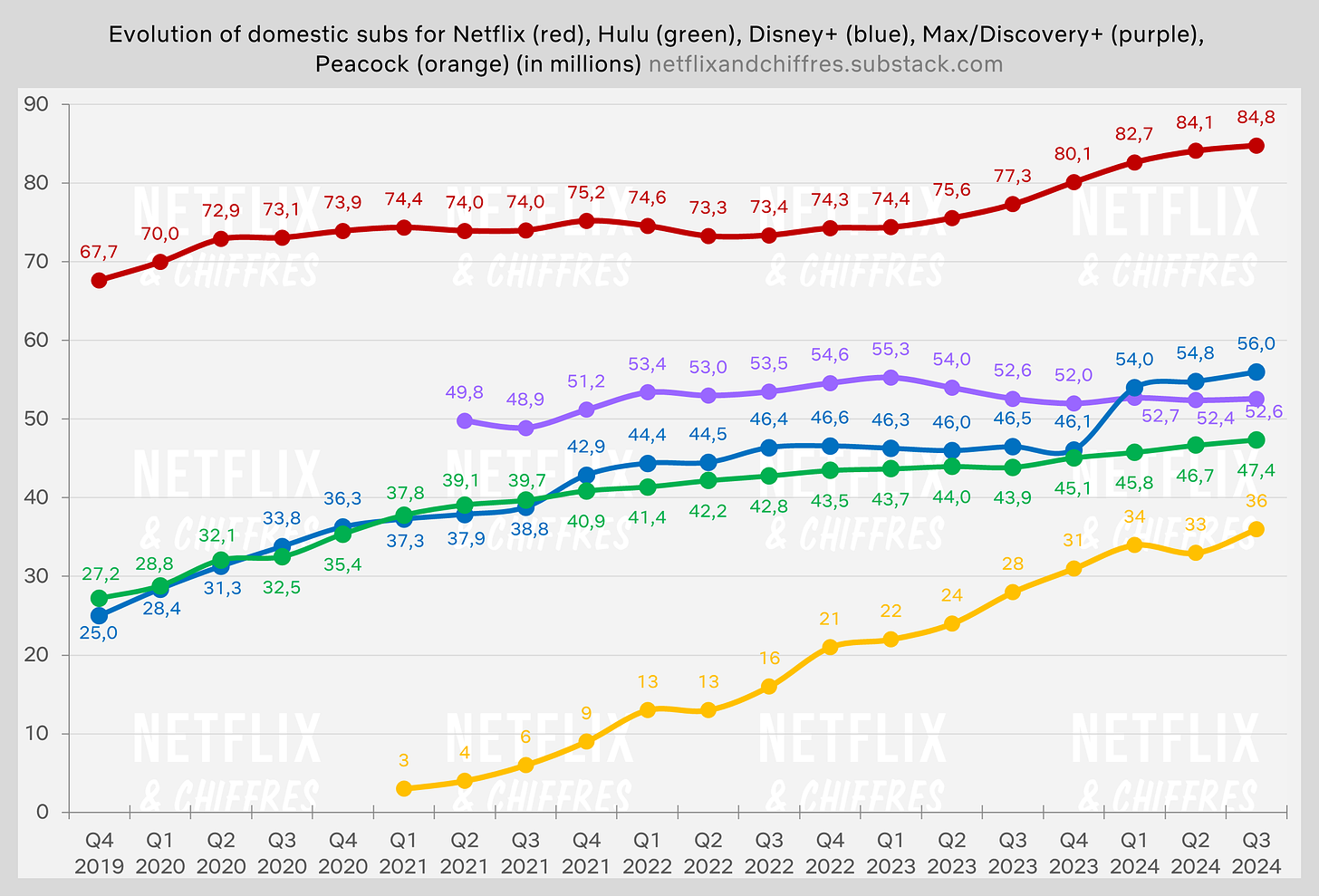

U.S. only streaming services.

Let’s quickly look at Hulu, which continues to grow its subscriber base in the U.S. Over the past year, the service has gained 3.5 million subscribers, while the ARPU is down compared to the previous quarter but up year-over-year.

Finally, let’s wrap up with Peacock, which added 3 million subscribers this quarter, crediting the Olympics for this strong increase. While this is a smaller increase than in Q1 2024 with the exclusive NFL game, it’s still notable. The key for Peacock now is to retain these new subscribers, especially since the subscription price has been raised, leading to a significant increase in ARPU compared to the previous quarter.

Subscription revenues have surpassed $1.5 billion this quarter, but losses remain significant, despite the revenue increase, at -$436 million, which is higher than the previous quarter.

Universal's global cinema revenues are up this quarter, with $611 million in revenue.

Overview of U.S. streaming services at the end of Q3 2024..

Disney+, Warner Bros. Discovery, and Hulu are floating above or around the 50 million subscribers in the U.S. and Canada. Peacock is also approaching this number, while Netflix is slowing down after the increases due to the end of account sharing. Let’s enjoy these numbers for Netflix, as they won’t be around in two quarters!

That’s it for this financial quarter! If you have any questions or comments, all the ways to contact me are below. I’ll see you in a few days for the analysis of the latest Netflix weekly charts.

GREAT data great chart.